Tax free cigs

Today we talk about Tax free cigs.

Como un apasionado amante de los cigarros, I¡¯ve always been curious about ways to enjoy my smoking experience without breaking the bank. That’s when I stumbled upon the delightful world of tax-free cigarettes. The thought of getting my favorite packs at discounted rates really excites me, and I want to share this journey with you. Let’s dive deep into the realm of tax-free cigs, exploring essential facts, figuras, and tips that can enrich our smoking experience!

Understanding Tax-Free Cigarettes

What are Tax-Free Cigs?

Tax-free cigarettes refer to cigarettes sold without the imposition of local, state, or federal taxes. En los EE. UU., state excise taxes can add an extra $2 a $5 por paquete. For a heavy smoker like me, who might go through a pack a day, that adds up quickly¡ªpotentially saving hundreds of dollars annually! Imagine saving up to $1,500 a year by opting for tax-free cigs!

Choose Your Situation

Traveling with Tax-Free Cigs

Traveling often exposes me to opportunities for duty-free cig purchases. Por ejemplo, when I visit countries where taxes on tobacco are significantly lower, I can take advantage of their duty-free shops. Each traveler can bring back 200 cigarettes from abroad into the U.S. without incurring tax penalties. This is an excellent way for me to stock up during vacations, enjoying not just the destination but also a fiscal win!

Buying Tax-Free Cigs Online

Finding Authorized Online Retailers

Searching for tax-free cigarettes online is an adventure of its own. I always look out for authorized online retailers¡ªthose who adhere to government regulations while providing tax-free options. Websites that have secure payment methods and customer service support are my first choices. Data shows that buying online can save me about 10% a 30% en comparación con las tiendas locales, depending on the brand and promotions available!

Benefits of Purchasing Tax-Free Cigs

Cost Savings Compared to Regular Prices

The allure of tax-free cigs is mostly about savings. Por ejemplo, while the average price for a pack of Marlboro cigarettes can be around $6 a $10, purchasing tax-free can drop that to approximately $4 a $7 por paquete. This translates into substantial savings, particularly for frequent smokers. When I see numbers like these, the decision becomes simple¡ªbuying tax-free is a financially savvy choice! De hecho, Según los informes de la industria, consumers saved about $2 billion annually by purchasing tax-free tobacco last year!

Shipping Options for Tax-Free Cigs

Free Shipping Over $99

Many reputable online retailers catch my attention with their shipping offers. Por ejemplo, I find retailers who provide free shipping for orders over $99¡ªthis is a great incentive! It encourages me to buy a larger quantity, leading to further savings. Según mis experiencias, buying in bulk not only secures free delivery but often reduces the per-pack price by an additional 5% a 10%!

Tax-Free Regulations in Different Provinces

Understanding Provincial Tax-Free Policies

Camping out at the local convenience store doesn’t reveal the complexities of tax-free regulations, which can differ greatly between states or provinces. Por ejemplo, in New York, the state excise tax on cigarettes is around $4.35 por paquete, while in Missouri, it¡¯s only $0.17! Cuando viajo, I always research local laws about tax-free purchases to avoid unexpected hassles. It’s estimated that different tax regulations affect over 30% de fumadores’ purchasing decisions across the U.S.

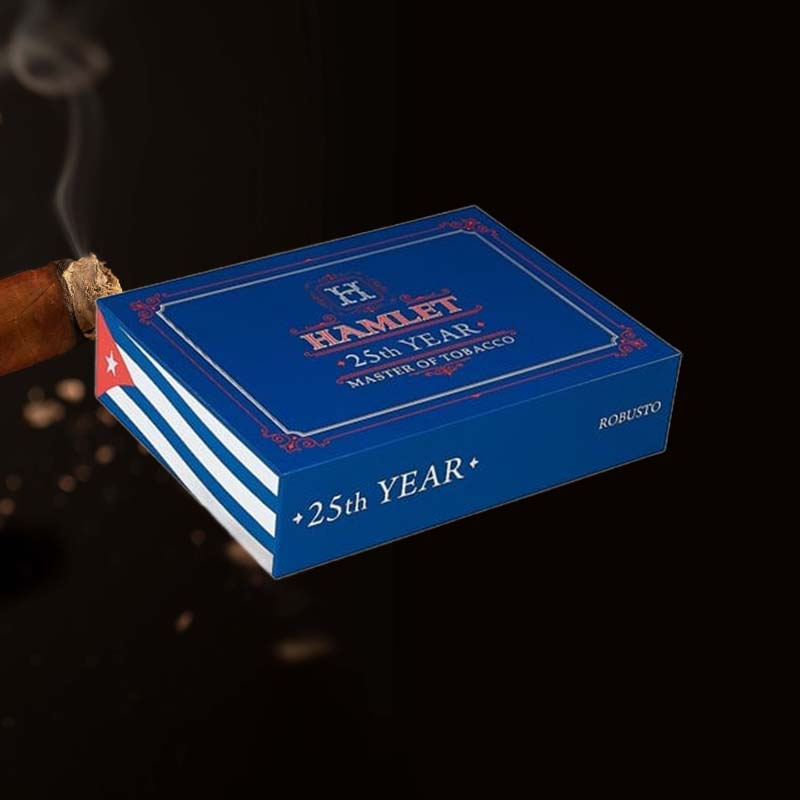

Popular Brands of Tax-Free Cigs

Marlboro and Other Leading Brands

I often find myself reaching for popular brands when purchasing tax-free cigs. The market shows that up to 40% of smokers prefer Marlboro, while brands like American Spirit and Camel have garnered substantial followings due to their unique blends. The price differences can range from $1 a $3 lower per pack for tax-free options, making them all the more appealing for someone like me who enjoys a variety of flavors!

How to Identify Tax-Free Cigarette Vendors

Recognizing Trusted Sources

Identifying trusted vendors for tax-free cigs is crucial. My checklist includes:

- Certification: Look for authorized retailer status.

- Revisiones de clientes: Aim for ratings above 4 estrellas.

- Información del contacto: There should be a legitimate address and phone number available.

En el mercado actual, Los estudios muestran que hasta 25% of online retailers may not be legitimate; careful examination has saved me from potential fraudulent sites!

Common Questions about Tax-Free Cigs

FAQs Related to Tax-Free Purchases

In the ever-evolving world of tax-free cigs, common questions arise like the limits imposed on purchases or the importance of understanding local regulations. By staying informed¡ªlike how several states have individual policies that dictate personal imports¡ªI can make educated decisions during my cigarette shopping sprees.

Contáctenos para más información

Consultas de servicio al cliente

If you encounter any questions concerning tax-free cigs, reaching out to customer service can be a lifesaver! Their expertise can guide you through the purchasing process, providing reassurance and clarity.

Related Resources and Links

Further Reading on Tax-Free Cigarettes

Diving deeper into tax-free cigarettes with government sites and industry-related articles can enhance my knowledge. Switching between online forums and professional reviews keeps me updated on trends and deals in the world of tax-free cigs.

Comentarios y sugerencias

How Can We Improve Your Experience?

Tus comentarios son invaluables! Sharing your input not only helps us enhance offerings but also makes our community stronger, especially in enriching the tax-free cig experience for all.

Únete a nuestro boletín

Stay Updated on Tax-Free Cig Offers

Staying informed is key, which is why subscribing to our newsletter offers insights into the latest tax-free cig deals. Don’t miss a chance to discover fantastic offers directly in your inbox!

Summary of Tax-Free Cig Benefits

Key Takeaways for Consumers

En resumen, tax-free cigarettes present notable financial benefits, especially for committed smokers. Whether it’s navigating different buying channels, understanding regulations, or simply opting for bargain brands, the potential savings are immense. I¡¯ve learned firsthand that purchasing tax-free not only brings joy to my smoking experience but also keeps my wallet happy!

Preguntas frecuentes

How much is tax free in Russia?

In Russia, travelers can buy up to 200 cigarettes tax-free at airports. This is an enticing opportunity for someone like me who enjoys sampling different brands from abroad!

Who has the highest cigarette taxes?

Australia is known for having the highest cigarette taxes in the world, often resulting in retail prices hovering around $30 por paquete. This fact reinforces the appeal of tax-free options for smokers.

How much are duty-free cigarettes in Norway?

In Norway, the price of duty-free cigarettes generally hovers around $10 a $12 por paquete, but the savings can be significant compared to local retail prices, que puede exceder $15!

Which country has the highest cigarette tax?

Australia, once again, features the highest cigarette taxes globally, with a tax burden that significantly discourages tobacco use. It’s a stark reminder of why tax-free options are sought after!